PARFUMS

Produits les plus vendus

Produits les plus vendus

Meilleures ventes

- Afficher tous

- Populaire ce mois-ci

- Liste des souhaits les plus populaires

- Choose category

- All categories

- Uncategorized

- Coffrets de parfums

- Enfant

- Femme

- Flacons et vaporisateurs vides

- Homme

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Added to wishlistRemoved from wishlist 0

Add to compare

Vous voulez acheter les meilleurs produits

Voir les dernières offres

Added to wishlistRemoved from wishlist 0

Fantasia 46192 Flacon de parfum carré avec pompe, Vaporisateur et bouchon Argenté 100 ml

Already Sold: 80%

Added to wishlistRemoved from wishlist 0

Added to wishlistRemoved from wishlist 0

Mont Saint Michel – Coffret 2 Produits – Coffret Cadeau – Eau de Cologne Après l’Orage – 250 ml – Crème Mains Nourrissante – 75 ml

Already Sold: 69%

Added to wishlistRemoved from wishlist 0

Added to wishlistRemoved from wishlist 0

Added to wishlistRemoved from wishlist 0

Added to wishlistRemoved from wishlist 0

Spa Luxetique Coffret de Bain, Coffret Soins de la beauté, 10 Pièces Coffret Cadeau pour Femme, Parfum de Lavande, Cadeau de Noël Saint-Valentin et d’Anniversaire

Already Sold: 63%

Added to wishlistRemoved from wishlist 0

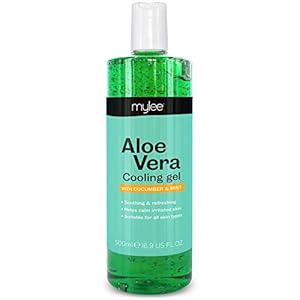

Gel adoucissant à l’aloe vera pur Mylee – Après soins – Épilation – Cire épilatoire – Traitement pour la peau – Après-soleil – 500 ml

Already Sold: 13%

Added to wishlistRemoved from wishlist 0

100% Natural Gel d’Aloe Vera 500 ml Excellent hydratant Visage & Corps Cheveux – Calmant Aprés Epilation

Already Sold: 21%

Added to wishlistRemoved from wishlist 0

Added to wishlistRemoved from wishlist 0

Added to wishlistRemoved from wishlist 0

Nous suivons les prix de plus de 20 magasins les plus populaires pour vous proposer les meilleures offres.

Offres quotidiennes

Already Sold: 12

Available: 16

75 %

Dépêchez-vous ! L'offre expirera bientôt

days

0

0

hours

0

0

minutes

0

0

seconds

0

0

Already Sold: 18

Available: 26

69 %

Dépêchez-vous ! L'offre expirera bientôt

days

0

0

hours

0

0

minutes

0

0

seconds

0

0

Already Sold: 21

Available: 31

68 %

Dépêchez-vous ! L'offre expirera bientôt

days

0

0

hours

0

0

minutes

0

0

seconds

0

0

Already Sold: 24

Available: 36

67 %

Dépêchez-vous ! L'offre expirera bientôt

days

0

0

hours

0

0

minutes

0

0

seconds

0

0

Vous avez trouvé quelque chose d'intéressant ?

moins de 99 euros

- Afficher tous

- Populaire

- Les plus révisés

- Les plus désirés

Added to wishlistRemoved from wishlist 0

Add to compare

Show next

Les avantages d’une douche extérieure : Profitez de la nature et de la fraîcheur

July 12, 2023

0

Avec l'arrivée des beaux jours, beaucoup d'entre nous cherchent à passer plus de temps à l'extérieur et à profiter du soleil. Une façon merveilleuse ...

Bien-être

Lanvin Mon Eclat ~ nouveau parfum :: Now Smell This

June 19, 2022

0

Le lemming quotidien

June 19, 2022

0

Le lemming quotidien

June 19, 2022

0

Sondage du week-end paresseux ~ fil ouvert, Juneteenth 2022

June 19, 2022

0

Miller et Bertaux Aymara ~ nouveau parfum :: Now Smell This

June 19, 2022

0

Lire les derniers blogs

Découvrez votre article préféré

![GeekerChip Vaporisateur Vide[100ml+50ml]flacon spray videBouteille de Voyage Vide,6pcs Plastique Transparent Réutilisables Atomiseur De Poche,Et trois entonnoirs](https://m.media-amazon.com/images/I/41kPKLSsB+L._SS300_.jpg)